Investing In Art

THE MENU

OUR ROLE

Artwork Advisory

Optima Wealth UK are proud to be working alongside not only some of the UK’s most prominent emerging artists and established figures but also a world renowned art advisor of whom has an abundance of knowledge in art from £200 to £2,000,000+. With over 40 years of passion being devoted to the industry, our partnership allows us to offer investment grade art for unbeatable prices.

Alongside our ‘seen on TV’ art advisor, we have a wide array of connections amongst collectors, enthusiasts and galleries, all looking to aid in the buying and selling of investment grade art.

Whatever your reasons are for investing in art, whether it be for your retirement fund or for it’s aesthetic value, there are factors that need to be considered when analysing the potential performance of the investment, such as does the artwork stand out from crowd or is the artist a risk taker and embraces a challenge. These are all factors that will be considered and discussed when utilising the Optima team and it’s art advisor.

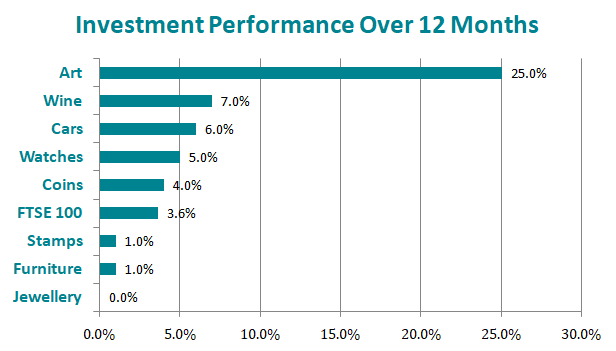

Art Outperformed Every Investment Class in 2018

Art was the best performing asset class of 2018. It achieved a 25% increase in value over a 12 month period, 21.4% more than the FTSE 100, and 18% above wine, the second best performing asset class.

*All data to Q2 of 2018. Source: Knight Frank, as part of Knight Frank Luxury Investment Index. FTSE 100 Source: Yahoo! Finance.

Why Invest In Art?

The art market has appreciated consistently for over 60 years, with very low correlation to other asset classes. Art has continued to grow leaving most other investment classes to decline or stagnate, even during one of the worst economic downturns recorded – outperforming most other forms of investment.

Source: www.ubs.com

Source: www.wsj.com

Source: www.deloitte.com

Art Investment Is Becoming Increasingly Popular

With recent artwork selling for record highs, it’s no surprise that the popularity of art investment has increased over recent years. Deloitte report that there is a growing client demand for luxury “personal investments”, with 88% of wealth managers believing art should be part of their wealth management offering.

While these numbers are attention grabbing, there’s also a robust market at much lower prices. Citi found that works under $50,000 actually offer “the best performing price point from both a return and a risk per unit of return basis,” adding that “there is no disadvantage from a return perspective to having a small purse.”

Especially with the art market’s ability to weather economic and political turbulence during the financial crisis of 2009, this provides confidence in the argument that art and collectible assets are worthwhile as a means to not only safeguard value, but to appreciate.

The Sotheby's Mei Moses Index: 1950-2018

Source: Sotheby’s 2018

Return On Investment

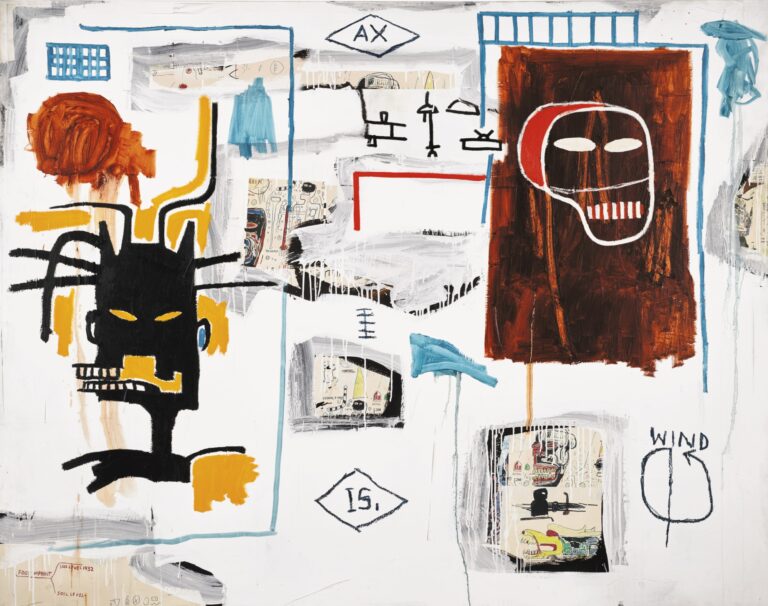

Jean-Michel Basquiat

Title: “Apex”

Acrylic, oil stick, Xerox collage on canvas

Annualised return 1528%

Bought For: £15,000

Sold For: £7,050,000

Banksy

Title: “Girl With Balloon”

Screenprint

Annualised return 93%

Bought For: £52,000

Sold For: £160,000

The Connor Brothers

Title: “Those Who Say It Cannot Be Done”

Oil on canvas

Annualised return 130%

Bought For: £25,000

Sold For: £35,000

Source: Bought from Christie’s on 30/6/88 & sold from Sotheby’s 5/3/19

Source: Bought from Bonhams 27/6/17 & sold from Sotheby’s 19/9/19

Source: Bought 6/8/18 & sold 26/11/18, both from Maddox Gallery

Want to know more...

Please get in touch and the Optima team will be happy to help.